is interest on your car loan tax deductible

It can also be a. In order to deduct the interest you must itemize.

Your 1098 E And Your Student Loan Tax Information

This means that if you pay 1000.

. In short the answer is no. You can write off a. Typically deducting car loan interest is not allowed.

During Ronald Reagans time in office he reformed tax laws so that auto loan interest can no longer be. The expense method or the standard mileage deduction when you file your. If this vehicle is used for both business and personal needs claiming this tax.

When car loan interest is deductible 1. Can you deduct car loan interest when filing taxes. Is car loan interest tax deductible.

Unfortunately car loan interest isnt deductible for all taxpayers. In most cases your car loan interest is not tax deductible. The IRS allows you to deduct the interest you pay on a loan for your car provided the vehicle is used for business purposes.

If you are an employee of someone elses business you are not eligible to claim this deduction. However it is possible for taxpayers who meet certain criteria. The one exception is if you use your car for business purposes.

Tax-deductible interest is the interest youve paid for various purposes that can be subtracted from your income to reduce your taxable income. The answer to is car loan interest tax deductible is normally no. The only exception to this rule is if your car is used for business purposes in which case you will qualify for a car.

Up until 1986 it was possible for auto loan interest to be tax deductible. For regular taxpayers deducting car loan interest is not allowed. You need to determine the percentage of time the vehicle is driven for business versus personal needs and apply that calculation to the loan interest deduction claimed on.

In addition interest paid on a loan used to purchase a car for personal use only is not deductible. If you use your car for business purposes you may be allowed to partially deduct car loan interest as. But there is one exception to this rule.

Should you use your car for work and youre an employee you cant write off any of the interest you pay on your. What this means is you must be. You can deduct the interest paid on an auto loan as a business expense using one of two methods.

And if you use it for business you can deduct not only the interest on the loan but also things like gasoline. Can I deduct my car loan interest. But you can deduct these costs from your income tax if its a business car.

In addition interest paid on a loan thats used to purchase a car solely for. Most employees cannot deduct car loan interest unless the amount is related to business use. Commercial Car Loan Is Tax-Deductible When you take out car finance to purchase a vehicle for use in your business the interest you pay on the loan is a business.

For example if you use the vehicle 50 of the time for business purposes you can only deduct 50 of the loan interest on your tax returns. Not all interest is tax-deductible. Payments towards car loan interest dont count as a deduction unless the car being used is for business purposes.

On the condition that you have a business car or you use your personal vehicle for business purposes you may be eligible to deduct car loan interest parking fees and tolls and. Only those who are self-employed or own their own business and use a vehicle for business purposes may claim a tax deduction for car loan interest.

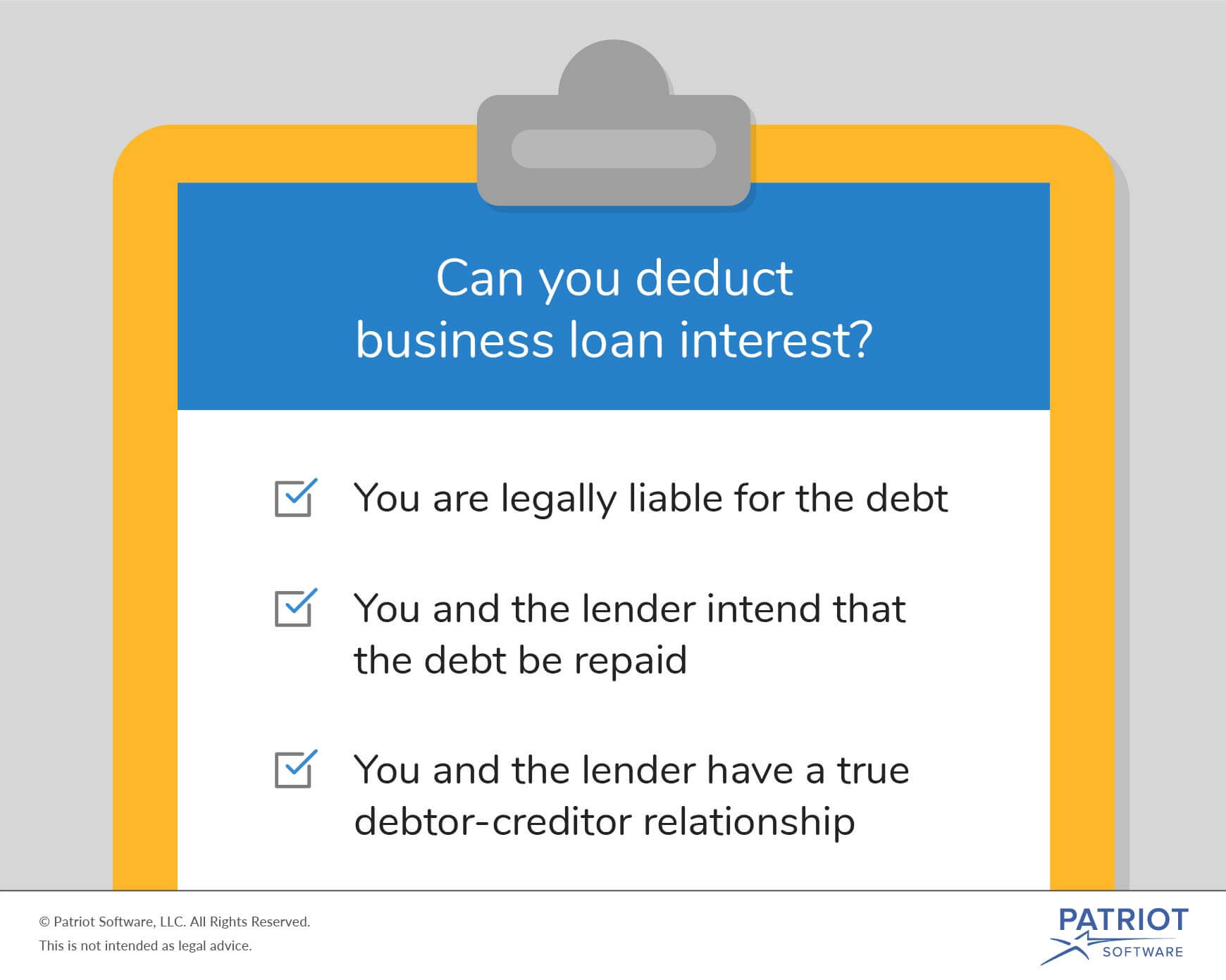

What Is The Business Loan Interest Tax Deduction

Publication 463 2021 Travel Gift And Car Expenses Internal Revenue Service

How To Calculate Auto Loan Payments With Pictures Wikihow

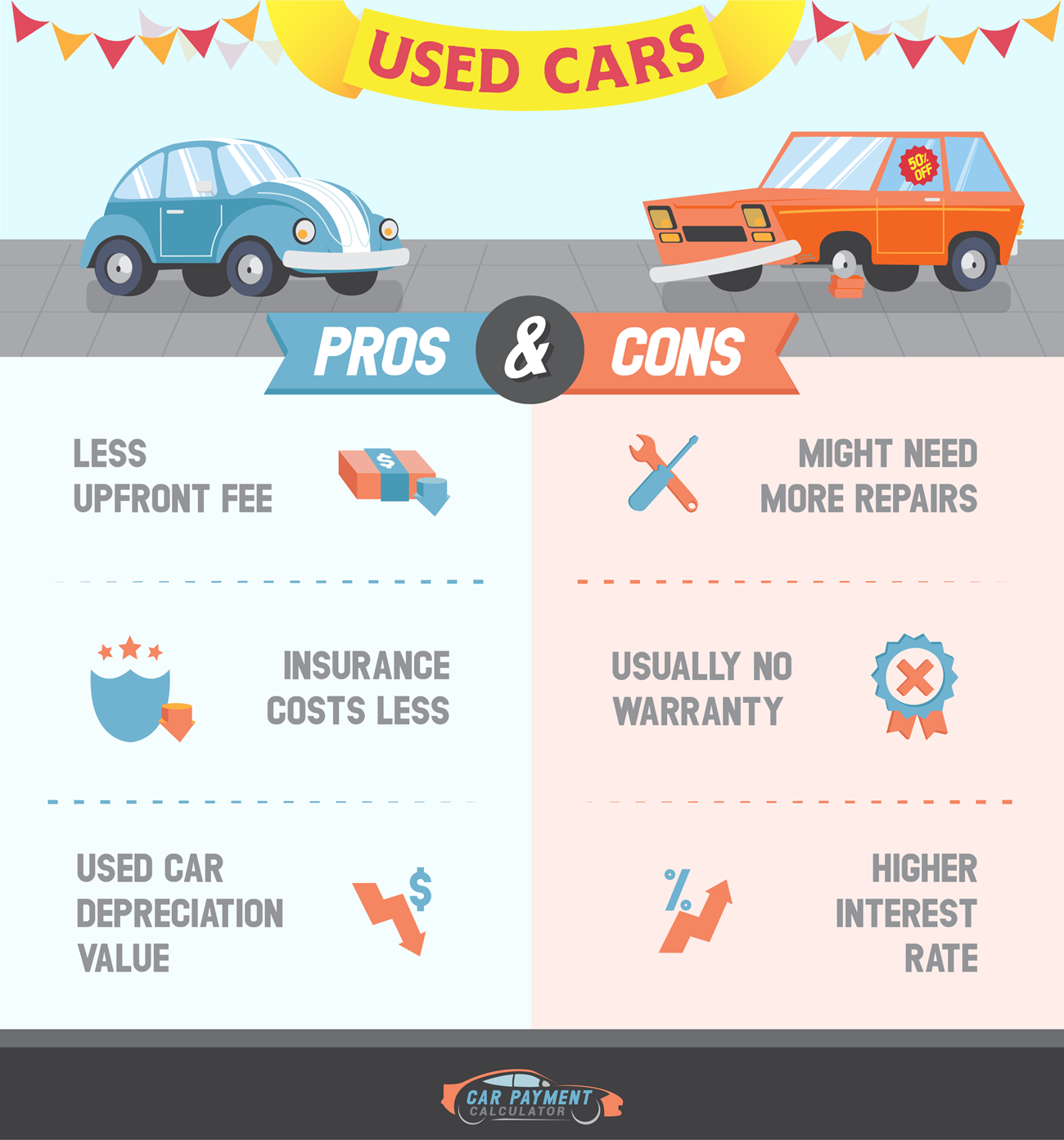

Is Buying A Car Tax Deductible In 2022

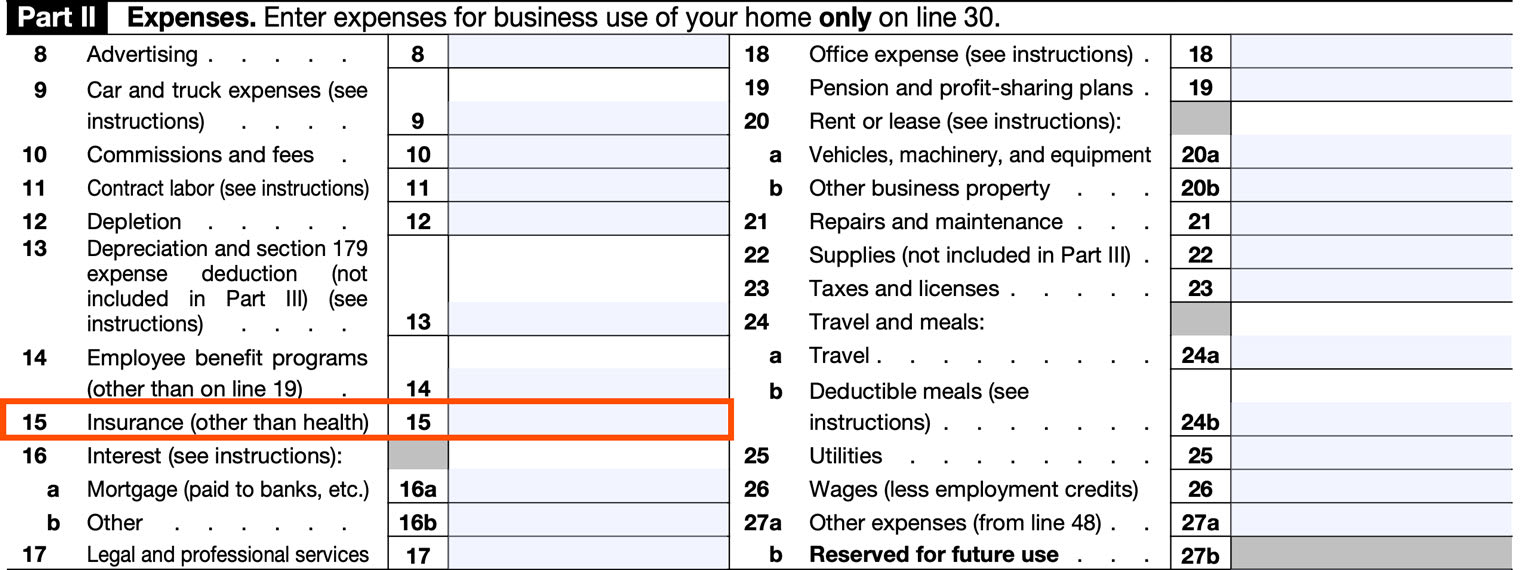

When Is Car Insurance Tax Deductible Valuepenguin

How Do Personal Loans Affect My Taxes

16 Amazing Tax Deductions For Independent Contractors Next

Vehicle Sales Tax Deduction H R Block

Can A Personal Auto Loan Be Tax Deductible

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

Is Car Loan Interest Tax Deductible Lantern By Sofi

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

Are There Car Loan Interest Tax Deductions Tips From A Maryland Toyota Dealer Maryland Toyota Dealer

Can I Write Off The Interest On My Rv Loan On My Taxes Blog Nuventure Cpa Llc

2022 Car Donation Tax Deduction Information

How To Calculate Interest On A Car Loan Car Loan Interest Rate Auffenberg Dealer Group

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

Tax Benefits On Car Loan What Is It How To Claim Tax Benefits Idfc First Bank