what is a quarterly tax provision

What is a Tax Provision. September 2 2021.

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year.

. Your annual tax return from the previous year is necessary to complete this form. Quarterly Income Tax Provision. A tax provision is the estimated amount that your business is expected to pay in state and federal taxes for the current year.

After calculation the system automatically translates the tax data from the local currency to the reporting currency for the consolidated reports. Our fiscal year estimated effective tax rate is based on estimates that are updated each quarter. The amount of this provision is.

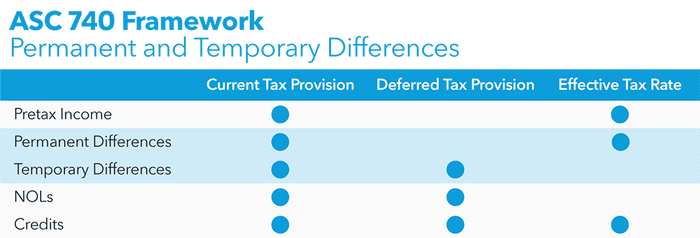

While a provision is a financial burden it also. Most corporations that issue financial reports utilizing GAAP will need to calculate a tax provision in accordance with Accounting Standards Codification 740 ASC 740. An income tax provision represents the reporting periods total income tax expense.

A quarter is a three-month period on a companys financial calendar that acts as a basis for periodic financial reports and the paying of dividends. A tax rate is generated at the beginning of the year for summary periods such as Quarterly or Yearly. Simply put a tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the.

An income tax provision is the income tax expense that will be reported on the companies financial statements. This includes federal state local and foreign income taxes. Documentation memos document the relevant analysis and the corresponding conclusions with respect to.

The tax provision is. Add your income tax and self-employment tax together and youll get to your estimated taxes for the year. What Is Tax Provisioning.

Tax rate changes in the quarter in which the law is effective. The ETR is forecast quarterly on a consolidated basis and then applied to year-to-date income. The tax provision is part of the audited financial statements and therefore it impacts the companys earnings and earnings per share.

A quarter refers to one-fourth. What is a tax provision. The provision for income taxes on an income statement is the amount of income taxes a company estimates it will pay in a given year.

1 summarization of the periods tax activities and compliance with FASB ASC 740. The amount of this provision is. Provision means the practice of setting aside a portion of your business income to use for a future expense.

In this case your total estimated tax bill for the year is 7795. The provision is the audit part of tax. For question 1 base company tax on 275 of annual profits paid quarterly for question 2 revenues 10-DCoverheads above loan repayments.

What is a tax provision. An Administrator or Power User can also create interim tax periods for example. Once filled out the forms worksheet will indicate whether you must file quarterly estimated.

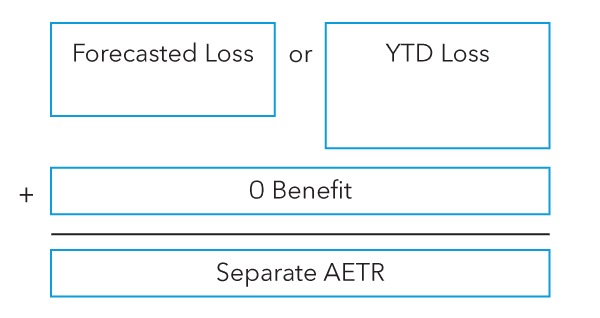

An income tax provision is an estimated. This guidance addresses the issue of how and when income tax expense or benefit is recognized in interim periods and distinguishes between elements that are recognized through. For the six months ended June 30 2014 our pre-tax.

They are prepared in accordance with ASC 740. Treating an item as discrete concentrates the tax effect in the quarter recognized while treating the item in the. The provision can be calculated on a monthly.

Typically this is represented quarterly.

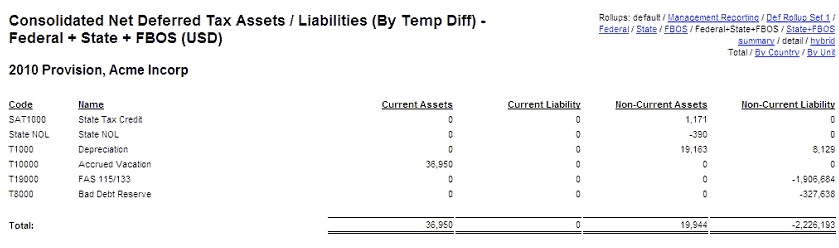

Onesource Tax Provision V2014 1

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Safe Harbor For Underpaying Estimated Tax H R Block

Asc 740 Interim Reporting Bloomberg Tax

Do You Owe The Irs A Quarterly Tax Payment August 15 Smallbizclub

Oracle Enterprise Performance Management Workspace Fusion Edition User S Guide

Manager Income Tax Cover Letter Velvet Jobs

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)

Form 941 Employer S Quarterly Federal Tax Return Definition

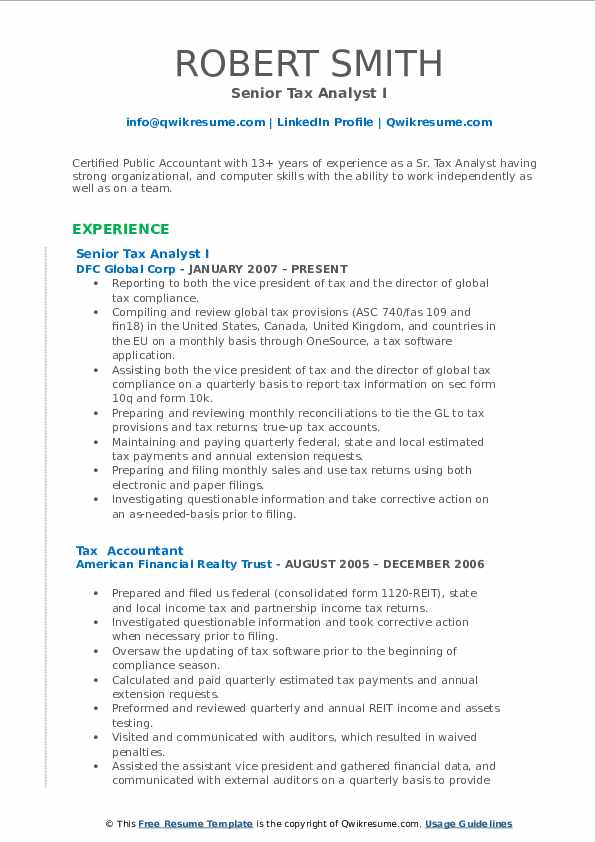

Senior Tax Analyst Resume Samples Qwikresume

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Senior Tax Associate Resume Samples Qwikresume

Senior Tax Analyst Resume Samples Qwikresume

5 Tax Traps Physicians Should Avoid

Bridging The Gaap To Tax The Importance Of The Income Tax Provision

Tax Accounting Provisions Perspectives Analysis And News Deloitte Us

Tax Accounting Cover Letter Velvet Jobs

Journal Entry For Income Tax Refund How To Record In Your Books